Telemarketing in the Insurance Industry

In today’s competitive insurance market, agents are continually searching for innovative approaches to increase their sales and expand their client base. Among the plethora of tactics available, telemarketing remains a potent tool for insurance lead generation. But how can agents harness the strength of this age-old method in the digital age?

Understanding Telemarketing in the Insurance Industry

At its core, telemarketing is a form of direct marketing where agents reach out to potential clients, promoting their insurance products. It’s essential to differentiate between pure telemarketing and its more advanced cousin, insurance telesales. While the former focuses on initiating a conversation, the latter often involves automated sales pitches or a more detailed sales process conducted over the phone.

Debunking the Myths

A common narrative in the business sphere is the diminishing relevance of telemarketing. Claims like “social media platforms have replaced the phone” or “telemarketing is long dead” are rife. Indeed, the digital age has brought about challenges such as increased opt-outs and the rising dominance of platforms like LinkedIn. However, these changes don’t negate the importance of telemarketing; they merely require a more nuanced approach.

Agents need to adopt a blended strategy. Younger generations, while often more engaged with digital platforms, still respond to personalised outreach. Moreover, the sheer volume of firms leveraging social media means that old-school methods, like telemarketing, can provide a competitive edge.

In-House Vs. Outsourced Telemarketing

One of the pivotal decisions insurance agents face is whether to manage telemarketing in-house or to partner with specialised firms. There’s no one-size-fits-all answer. While some agents find success with in-house teams, others thrive using outsourced services.

The essence lies in understanding the leads’ quality and timeliness. For instance, an in-house team might offer real-time leads, ensuring minimal time delay between the initial call and follow-ups. On the other hand, specialised telemarketing firms bring industry expertise, often resulting in more refined lead lists and effective scripts.

Strategies for Success in Insurance Telemarketing

Harnessing the full potential of telemarketing requires a blend of traditional techniques and modern innovations.

Here are some proven strategies:

- Know Your Audience: Begin by defining your client’s personas. Understanding your target demographic’s characteristics, needs, and preferences is the cornerstone of any successful telemarketing campaign.

- Optimise Call Timing: Research indicates that individuals in rural areas are more likely to answer calls than those in urban centres. Similarly, evenings often yield better results than afternoons. Adjusting your calling times based on these insights can drastically improve response rates.

- Invest in a Robust CRM: A comprehensive CRM or lead management system is indispensable. It enables agents to manage and analyse customer interactions, ensuring no leads fall through the cracks.

- Train and Monitor Your Team: Regular training sessions ensure that your team is well-versed with the insurance products. Monitoring calls and gathering feedback can further refine your approach, making every call count.

- Scripting with Flexibility: While having a script is crucial, agents should be trained to deviate when necessary, personalising the conversation based on the client’s reactions.

Agents need to adopt a blended strategy. Younger generations, while often more engaged with digital platforms, still respond to personalised outreach. Moreover, the sheer volume of firms leveraging social media means that old-school methods, like telemarketing, can provide a competitive edge.

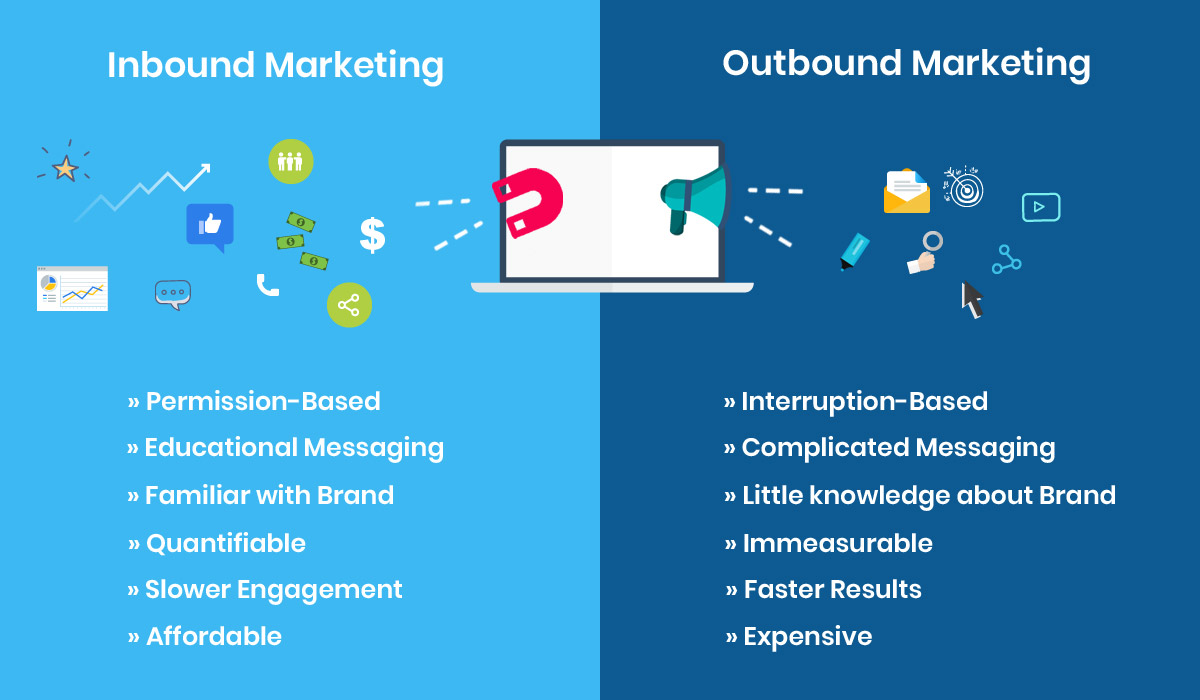

Inbound Vs. Outbound Telemarketing

Another crucial distinction in the realm of insurance telemarketing is between inbound and outbound strategies. While outbound focuses on cold calling potential clients, inbound revolves around handling inquiries initiated by customers, often driven by other marketing tactics.

Handling sales calls, irrespective of the approach, requires expertise. From straight selling, where agents explicitly promote products, to spin selling, which focuses on identifying and solving customer problems, agents must master various techniques to maximise conversions.

Modern Adaptations in Insurance Telesales

With the rise of digital platforms, insurance telesales strategies have adapted and shifted. Telemarketing isn’t solely about calling potential customers; it’s about integrating those calls with other digital approaches.

For instance, LinkedIn has become a goldmine for insurance agents. By leveraging this platform, agents can research potential leads, understand their needs, and tailor the telesales pitch accordingly. By merging telemarketing with LinkedIn agents can harness the power of social insights to make their pitches more personalised and effective.

Furthermore, the use of advanced CRM systems Lead management has revolutionised how insurance agents manage their prospects. Such systems provide detailed insights into each lead, ensuring that agents can track their interactions and improve the chances of conversion. The blending of telemarketing with modern CRM technology ensures that every call counts.

The Power of Active Listening in Telesales

Active listening plays a crucial role in successful telemarketing. It’s not just about speaking; it’s about understanding the needs, objections, and desires of potential clients. For insurance agents, this means not just pitching a product but crafting a solution tailored to each individual.

For instance, if a potential client is concerned about the rising costs of their current insurance, an agent can address this directly by offering solutions or alternatives that might better suit their budget. By actively listening, agents can navigate objections with ease and confidence.

The Future of Insurance Telesales

As the world evolves, so does the art of telemarketing. With advancements in AI and machine learning, predictive analytics can now guide insurance agents on the best times to call leads or even predict which leads are most likely to convert. This intelligent approach ensures that telesales for insurance companies remains a vibrant and effective strategy in the modern age.

While some may argue that the era of telemarketing is fading, the numbers tell a different story. Insurance agents who adapt, merge traditional methods with modern technologies, and understand the power of platforms like LinkedIn and advanced CRM systems are witnessing impressive results.

It’s clear that for those willing to evolve, telemarketing remains a potent tool in the insurance industry. From the active listening techniques to the modern digital integrations, the future of insurance telesales is bright and promising.

Telemarketing, when executed correctly, can be a game-changer for insurance agents. By blending time-tested strategies with modern innovations, agents can not only meet but exceed their sales targets, proving that telemarketing is far from obsolete.

Are you ready to level up? In a world that’s constantly evolving, standing still is not an option. Whether you’re aiming to enhance your skills, refine your strategy, or simply gain a competitive edge, one-on-one guidance can make all the difference. Don’t miss out on the opportunity to accelerate your progress. Book a call with our experts today and embark on the fast track to success.